This is my third article on personal finance in just two weeks. Based on my current thinking, there will likely be more to follow. You might wonder why I’m diving into a topic where I don’t consider myself an expert. Truth be told, I’m grappling with it, searching for answers in a sea of questions.

So, why write about it? Shouldn’t you need to be a master to publish something meaningful on any topic? I don’t think so. The truth is, I’m on a journey to mastery.

Not long ago, I shared how I was paralyzed by the fear of writing again. For over four years, I hadn’t put pen to paper—or fingers to keys—on anything of substance, at least nothing that reached the level of vulnerability I find valuable. What held me back? A fear of exposing my unfiltered, half-formed thoughts.

Life often presents us with a choice: we can wear a mask of perfection (the kind that resembles a reality TV persona) or we can choose to be authentically vulnerable, revealing our flaws to the world. When faced with this decision, I consistently opt for authenticity.

But this raises an important question: how can you be genuinely authoritative while writing on a subject when you’re not yet an expert? How do you articulate thoughts on something you’re still trying to grasp? The quick answer is: don’t. Avoid situations that require you to be a master. The master is the one who stops learning.

Our perceptions have been shaped by a world where gatekeepers once held sway over industries, including publishing. This has led many of us to believe that only experts can share their insights. For everyone else, it’s best to remain silent until you can claim expertise.

In my early 20s, it was easy to excuse myself for writing on topics where I lacked qualification; my inexperience was clear, and others would often see through it. However, I learned a lot by taking risks and discussing things I wasn’t fully qualified to talk about. Yet, as I’ve gained more experience and context, the pressure to present myself as an expert has grown. Admitting ignorance has become increasingly challenging.

This inner conflict has lingered, but here’s what I’ve come to realize: my writing isn’t about showcasing expertise. It’s a tool for clarity and a path to mastery. By putting my thoughts on paper (or screen), I force them to crystallize. I could keep these reflections private, but where’s the fun in that? There’s a certain thrill in exposing my uncertainty, in saying, “I’m still figuring this out.” After all, sooner or later—at least within the next 50 years—we will all die, and this won’t matter at all.

Embracing this desire to write while shedding the need to present as an expert has led me to adopt a new identity: that of a perpetual student. This perspective removes the pressure to always be right. Instead, I’m eager to share my learning process, even as my understanding evolves. I may contradict myself from time to time as I learn more, but my goal is to be less wrong today than I was yesterday. This transforms my writing into a conduit for engagement, conversation, and learning.

So, why focus on personal finance?

For the past eight years, I’ve been immersed in building startups—often without enough disposable income to think seriously about personal finance. Consequently, I’ve neglected this vital area. It wasn’t relevant at the time because I believed I would eventually receive a lump sum from a liquidity event and then work with money managers to plan accordingly.

Well, that liquidity event hasn’t happened yet. But like any muscle that has not been exercised, my wealth-building knowledge is now weak and requires attention to develop. Given that I’m drawing a salary, it’s time to start flexing that wealth-building muscle. The first step is to begin learning about wealth building, and writing about personal finance seems like one of the quickest paths to understanding.

“There is nothing you can buy from a shopping mall that you will give a fuck about in 10 years or more”

- Jimmy Carr

Now, let’s tie this back to the title of the article.

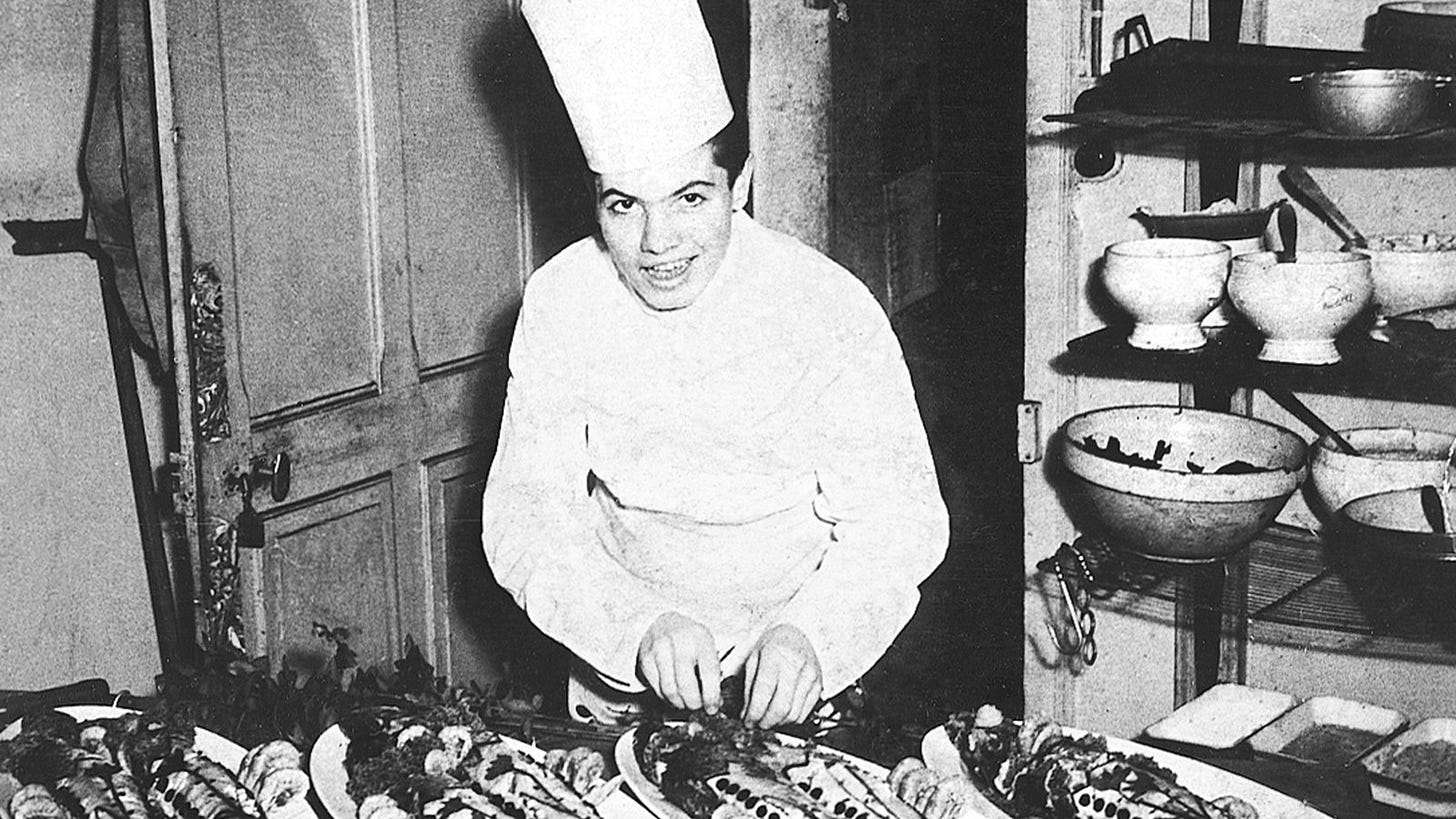

I borrowed it from my CEO, Benjamin. When Nala raised a $40 million Series A, he invited one of our investors, Sheel, to Times Square for the display of a congratulatory message from Nasdaq. Sheel responded, “A chef doesn’t celebrate getting ingredients,” reminding Benjamin and the rest of us that the real work begins after securing resources. At Nala, we’ve adopted this mantra: it’s time to cook.

This resonates with my current experience as a salaried employee. It’s easy to get caught up in the allure of a paycheck, leading to unnecessary and frivolous spending. As Jimmy Carr quipped, “there is nothing you can buy from a shopping mall that you will give a fuck about in 10 years or more”.

We often forget that a salary—much like the investment Sheel’s firm made in Nala—is a seed meant to be planted and nurtured for future growth, not devoured or celebrated in isolation. Our salary or income from trading our time should cover essential needs and be invested in what will matter down the line. For me, that means health, family, and building more wealth.

As we approach the end of the month—a salary week for many—it’s crucial not to squander every penny earned. It’s essential to budget your money on paper before it even arrives.

Structure your financial life so that the processes for investing in things that will matter five years from now are easy, while those for spending on frivolous things that will only matter today are hard. For example, you can set up direct debits so that you don’t even need to do anything to move money aimed at investments. For expenses that won’t matter in the near future, transfer the money to an account that requires extra steps to access.

Remember, a chef doesn’t celebrate merely acquiring ingredients; they get to work turning those ingredients into something remarkable. That’s the real celebration. So, ask yourself: what will you be cooking with your salary?